Just here, working through the details....

OMG please pray I can find an attorney that has experience in doing this!!!!!!

Section 350(b) of the US Bankruptcy Code allows a bankruptcy court to reopen a closed case under certain circumstances, which could include a debtor wanting to reaffirm a debt at the time of discharge, but only at the fair market value of the secured property at the time of the bankruptcy petition filing; essentially allowing them to "re-enter" the case to formally reaffirm a debt on specific terms, usually to keep valuable collateral like a car or house. This can also potentially stop a foreclosure. By reopening a case will triggers an "automatic stay" that temporarily halts foreclosure proceedings, if the court deems it appropriate to do so based on the circumstances;

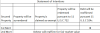

Key points about Section 350(b) and reaffirmation:

Reopening a closed case:

This section enables a court to reopen a closed bankruptcy case to address issues that may have been missed or to allow further actions, like reaffirming a debt, if necessary.

Fair market value at petition filing:

When reaffirming a secured debt under Section 350(b), the value of the collateral is

typically considered at the time the bankruptcy petition was filed, not the current market value.

Court discretion:

The court has discretion to decide whether to reopen a case under Section 350(b) and will consider factors like the reason for reopening and whether any parties would be prejudiced.

Good faith requirement:

To successfully reaffirm a debt under Section 350(b), the debtor must act in good faith and demonstrate a clear understanding of the terms of the reaffirmation agreement.

when reaffirming a secured debt under Section 350(b), the value of the collateral is generally considered at the time the bankruptcy petition was filed, not the current market value; this means the valuation is based on the "petition date" value, not the "present" value.

Explanation:

Purpose of valuation:

The primary reason for using the petition date value is to ensure fairness and consistency in the bankruptcy process, as it provides a fixed point in time for determining the secured creditor's claim against the collateral.

Impact on reaffirmation:

If the value of the collateral has increased significantly since the petition date, the debtor may be able to negotiate a better deal with the creditor when reaffirming the debt, as the creditor's claim is based on the lower petition date value.

Key points to remember:

Legal requirement:

Section 350(b) of the Bankruptcy Code outlines the process for reaffirming a secured debt, and courts typically interpret this section as requiring the use of the petition date value for collateral valuation.

Exceptions may exist:

In rare circumstances, a court may consider a different valuation date if there are significant changes in the collateral's value due to unusual market conditions or other factors.