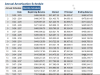

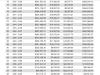

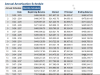

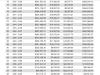

Mortgage Calculator

Here's Clips from the mortgage calculator and more thoughts on income--- This shows that the 40 year term at 4.48% payment is 2174 (but if your taxes and insurance are higher percentage than estimated

this increases the payment) So roughly, your original loan payment is about this amount at a 40yr amortization with a 30 year balloon of approx 209K. You would need enough to support roughly this payment. Times 3. (2174x3=6522/mo income) As someone else said, this may be 40% ratio. Roughly, you need 5-6K per month to be comfortable on the payment. But a minimum of 4200/month would support a 50% ratio of income to mortgage. Some lenders do this but the 50 percent ratio on *mortgage* being "affordable" has changed. Another way is to calc 50% - 55% ratio on ALL debt instead - such has including auto pay and insurance too. (called backend) Do not count income that is not steady like room mates or random Ebay business. This is bonus irregular income not steady income. You can add these later once you have a goal to meet. For now bank any excess where you can. Try to obtain a regular consistent 4-4500 and go from there. Also check the calculator to see if a reduction in percentage rate will lower your payment. In general, the mod should reduce your payment a few hundred or it won't help matters. This may be the option you get and/or balloon at the end of whatever has been missed. At least you will buy time to increase your income and possibly refinance before the balloon is due in 15 years.

Since you are in California, you likely have a higher insurance and taxes. (500K is the Taj Mahall in the South, but I'm sure your property is likely NOT SO in your area. lol) I have discovered taxes are based on loan amount, so this amount will be based on your original loan and property sale and may increase periodically with city/state legislation or "reviews" form your local Property Valuation Admin. You can actually dispute this amount and lower it if your property needs work... but you have to follow the rules on it. This can possibly lower your overall payment *after* the modification. It is the only thing you can control independently.