by Moe Bedard | Aug 5, 2021 | Mortgage Help |

A loan modification changes your current mortgage contract, such as a reduced interest rate or extended loan terms agreed upon by the lender and the homeowner.

For homeowners struggling to manage or behind on their current mortgage payments, a loan modification will probably be the best option to help your current situation. The purpose is to help make your mortgage more affordable so you can avoid foreclosure.

For example, the lender modifies the existing loan(s) to work with the homeowner because of financial hardship by changing the mortgage terms from an adjustable-rate mortgage (ARM) to a fixed-rate loan. They may also extend the loan term from 30 to 40 years or decrease the current interest rate to make the monthly payment more affordable.

Every mortgage servicer in the U.S. has loss mitigation programs in place and offers loan modifications to borrowers who they deem are qualified. But please keep in mind that they are not required to modify your mortgage, and there are no laws that state they must fix your loan so you can save your home.

A key factor required in every loan modification submission is the existence of hardship. The hardship can be temporary in nature or permanent. Still, the borrower must prove the hardship such as financial hardships, job loss, loss of income, rate adjustments on adjustable-rate and subprime mortgage products, etc.

The earlier you address the issue, the better the chances of negotiating a fixed rate and a manageable payment.

What are the types of hardships?

The following list are a sample of hardships that are deemed acceptable by mortgage servicers

1. Adjustable Rate Mortgage – Reset-Payment Shock

2. Illness of the Borrower

3. Illness of a Borrower’s Family Member

4. Curtailment of Income

5. Loss of Job

6. Property Problems

7. Inability to Sell the Property

8. Mortgage Servicing Problems

9. Reduced Income

10. Failed Business

11. Job Relocation

12. Death of the Borrower

13. Death of Spouse or Co-Borrower

14. Death in the Family

15. Incarceration

16. Divorce

17. Marital Separation

18. Military Duty

19. Medical Bills

20. Damage to Property (natural disaster or unnatural)

How does the process work?

A loan modification is simply done by negotiating a lower payment with your current lender on your current mortgage contract.

The process works by modifying and improving the current terms and/or the interest rates on your existing mortgage. Do not confuse it with refinancing because you would not be making payments to satisfy an existing loan; this means that there are no loan closing costs.

It can easily take anywhere from three to twelve months or more to complete, and in some cases up to two years or more. Even if you feel like you’re a perfect candidate for a loan modification, you will most likely have to jump through several hoops before you reach success.

Just try to always be very polite – but firm – each and every time you communicate with your servicer. Keep track of dates/times and the name of any representative you speak with, this may come in handy later if you get conflicting information from a separate department.

The key when applying for a loan modification is to have patience and be persistent. This process may take a long time and be stressful. Try to control this stress and understand that what you cannot control is not good to stress over. This is just business to these big banks and mortgage servicers. If you remember this and do the same yourself, it will help you deal with the stress and sometimes the comedy of it all.

Do the best you can, stay as positive as possible, and hope for the best. By doing this you will take care of business, and also have a life with your loved ones.

What will I need to apply?

Here is a list of items you will need when you submit your loan modification. It is best to gather all these items before you even approach your mortgage servicer and keep this paperwork all organized in a single file for quick reference and or updating.

1. Financial statement

This worksheet can be defined as a document that contains a borrower’s monthly income and expenses that they wrote down. Accuracy of the information on this worksheet is a major factor in eligibility. The absence of debts may disqualify you, due to the fact that your servicer is going to uncover them eventually whether they are on the document or not.

2. Hardship letter

As mentioned above, hardship letters help to outline the events that have led to your mortgage becoming unaffordable. Although crucial information needs to be addressed in this letter, it also needs to be straight and to the point. Using over 2 pages to describe your situation is actually overdoing it.

3. Proof of income

Usually, income must be verified for each borrower who lives in the primary residence. Evidence of income classifies as:

– Monthly pay stubs for salaries of hourly wages.

– Most recent quarterly profit and loss statements of the self-employed.

– Copies of statements or letters from providers of the unemployed or disabled who need federal benefits to live. The statements or letters should include how long you will be receiving the benefits or the 2 most recent bank statements proving the income.

– The copies of the divorce decree, separation agreement, or other agreements in writing filed with the court explaining how much you will be paid and the amount of time in which it will be received for those who receive alimony or child support.

4. Tax Authorization (IRS 4506T-EZ Form)

Your lender needs this form for permission to request a copy of your most recent tax return from the IRS. Borrowers should make copies of this form for their own records.

5. Bank statements

At least two months of bank statements are required when applying for a loan modification. Bank statements enable a lender to see your total income and expenses and how they are being distributed each month. This transparency will help them make their decision. It is common to have to send in statements multiple times during the process, so trying not to get frustrated.

Here are some more tips to help you along in the process

1. Being punctual

Instead of waiting to default on your monthly payments, you could contact your servicer’s loss mitigation department to apply for assistance. Waiting to get into trouble never helps make a situation better. If you are suffering financially, take action. Patience is a virtue that must be practiced during the loan modification process, not before you even think about submitting the application.

2. Researching

As we promote nearly daily here on LoanSafe, the best way to get the best options is to do your research. While starting at resources like our own forum here on LoanSafe.org can be helpful, the best research always comes from the source. The Making Home Affordable Program, the Freddie Mac Streamlined Modification Initiative, the Fannie Mae streamline, and several other loan modification sources all have websites that anyone can go to for more information.

3. Writing

Hardship letters are always vital tools for borrowers who are facing the reality of foreclosure. While being comparable to hardship evidence, a hardship letter differs in that it sets the stage for a borrower to open up to their lender or servicer and allows them to be honest about their situation. Loan modification and short sale processes generally request it. Sample hardship letters and instructions can be found here on here on LoanSafe.

4. Staying organized

Because all loan modification programs request basic financial information such as paystubs, bank statements, 2 years’ worth of tax returns, recent mortgage statements, and a financial budget you have, the organization is more vital than ever when pursuing a loan modification in 2014.

5. Remaining assertive

When trying to get a loan modification in 2014, you’ll want to remain respectful while at the same time never taking no for an answer. Because the submitting of an application requires constant follow-ups on the phone, it takes the right type of assertiveness of the phone when going after a loan modification. Calling at least 2 times per week will help obtain a positive outcome.

6. Being realistic

Realism does not mean signing the first deal that is presented to you. Bargaining still exists in a world where regulations are ruling the industry. At the same time, remember that those with the power are the ones who make the final decisions; Especially if your loan is owned by Fannie Mae or Freddie Mac.

7. Document everything

This trait falls under the category of staying organized as well. Legal ramifications require borrowers to leave paper trails for themselves in order to get as much help as possible with the least amount of trouble possible. Keeping detailed logs, notes on conversations, and tabs on status updates are crucial tools when pursuing a loan modification this year.

8. Being patient

With some timelines adding up to 90 days to complete, the loan modification process is a process that requires the utmost patience.

IMPORTANT NOTE: It is essential during the loan modification process that you call your servicer regularly after you have sent them all your paperwork. Finding out which department is handling your file is crucial as well.

Where can I find more assistance?

What if I need help negotiating with my lender or do not have enough time to call in weekly for updates?

For those out there who need some housing counseling, I suggest you visit the Consumer Financial Protection Bureau’s (CFPB) “Find a Counselor” tool to search for counseling agencies in your area.

You can also call the HOPE™ Hotline at (888) 995-HOPE (4673) or for other mortgage and financial resources, visit: https://www.consumerfinance.gov/coronavirus/

There are some excellent non-profit organizations out there that can assist you through this difficult process. Two non-profits I have found to be very reputable over the years are HOPE NOW and Neighborhood Assistance Corporation of America (NACA).

Now that you have some information about modifications, it is now time for you to begin the process yourself.

You can also join our free forum with any questions they may have, where you will find many homeowners just like yourself in need of assistance.

by Moe Bedard | Oct 3, 2021 | Mortgage Help |

If you are unable to pay your mortgage, refinance, or get a loan modification, you may be able to qualify for what is called a “deed in lieu of foreclosure.”

A deed in lieu of foreclosure (DIL) is a legal procedure in which you willingly transfer your property’s title (deed) back to the lender.

In return, the lender agrees to release you from all legal obligations to the mortgage contract. This will be done to satisfy a defaulted loan and to prevent foreclosure proceedings.

A DIL is often better than just walking away from your home and letting it fall into foreclosure because it has a less detrimental effect on your credit score.

You can also negotiate with your lender so that they will not legally come after you to collect any money you may owe on the mortgage in back payments and fees after the lender has sold the property.

On the other hand, a deed in lieu is also beneficial for the lender because it avoids the costs and effort required for a foreclosure sale.

What are the elegibility requirements?

You may qualify for a DIL but let me warn you that this is not an easy process. Before your mortgage servicer even considers this option, you must meet specific elegilibility requirements;

- You cannot afford your current monthly mortgage payments

- The property must be your primary residence, not an abandoned or investment property.

- You’re experiencing financial hardship, such as losing your job, reduced income, significant illness, divorce, or another difficulty.

- You’re unable to obtain a loan modification and have exhausted all other loan workout options and financial resources available to you.

- You tried to sell your property with a licensed real estate brokerage at fair market value for at least 90-120 days but were unsuccessful

- You don’t wish to stay in your house due to other circumstances, such as a job relocation

- You must have actively explored and exhausted all other options and financial resources available to you.

How do I get a deed in lieu of foreclosure from my lender?

In general, a deed is a right granted by a legal contract based upon mutual agreement; therefore, a deed-in-lieu must be based upon voluntary agreement in good faith.

To proceed with a deed in lieu, both parties must agree to and sign both an Agreement in Lieu of Foreclosure, which outlines the terms of the deed and the deed itself, which transfers legal ownership of the property.

For the agreement to be reached, the property’s appraised market value must be less than the original agreement’s outstanding debt, and the property must not be subject to any 3rd party creditor claims or liens.

A third party escrow service then executes the legal agreement, which will release both you and the lender from the original contract.

Once the agreements are reached and there a clear title, the lender then classifies the original loan as paid and issues a waiver to a deficiency judgment. This will typically go into effect if the property’s sale results in less than what is owed on the debt.

Please be advised that many lenders may not be amenable to a deed in lieu because they believe they will have a better title after a standard foreclosure sale. This is because a trustee’s deed of sale effectively erases any judgment liens and second and third mortgages after a foreclosure. Thus, it would depend on the borrower’s lender whether they will accept a deed in lieu or not.

How will it affect my credit?

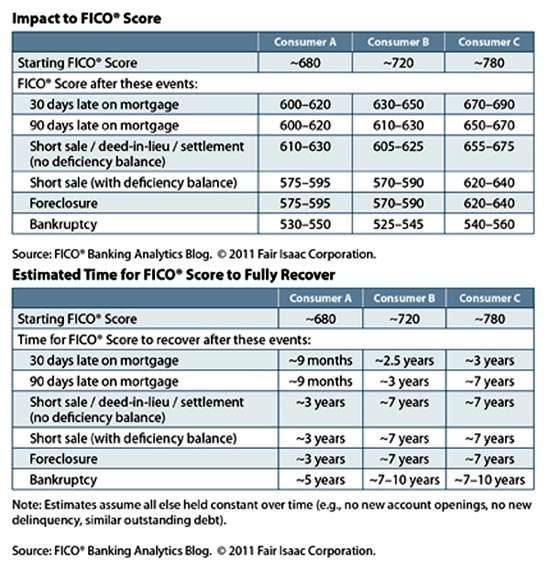

A deed in lieu of foreclosure will cause a negative impact on your credit score. According to a 2011 FICO study, if you begin with a score of approximately 720, it will drop 105 to 125 points off your score; but if you start with a score of 680, you’ll lose 50 to 70 points. But please be aware that your score will drop a lot more if there is any deficiency balance owed.

Here are the charts from FICO;

With that said, you can expect to lose from 50 points minimum to 250 or more points depending on your credit score when you started and if you own a deficiency balance or not. The credit report will also reflect the deed in lieu for seven years, although a borrower can still rebuild their credit.

However, the ill effect on the credit score gradually lessens in time, and you may request its removal from a credit report towards the closing of year seven.

Tax Consequences

Please be aware that if you can complete a deed in lieu of foreclosure, you will still be liable for taxation on the cancellation of indebtedness or COD income. The tax results would be based on whether the loan is classified as a non-recourse loan or a recourse loan.

You can find out if your loan is recourse or non-recourse in your original loan documents that were initially signed by the lender and borrower.

A, if the basic rule of thumb is that if a lender’s only option is to take possession of the property when the borrower defaults, it is a non-recourse loan. However, if the lender can go after the borrower to collect any shortfall when the property is sold, then it is a recourse loan.

A lender will submit a Form 1099-C to the IRS in the case of a shortfall. This is known as the borrower’s COD income.

In the case of a non-recourse loan, the IRS will consider the deed’s tax consequences in lieu as if the borrower had sold the property. If the property’s current market value is less than what is owed, the borrower will have a personal loss, but this is not tax-deductible.

On the other hand, if the property’s value is greater than the outstanding loan, the borrower will have a gain that may not be taxed if he is able to comply with IRS Sec. 121 two-year residency requirement. In the case of a recourse loan, the situation is similar to the non-recourse loan except that the borrower will also be taxed for COD income if the property’s value is less than what is owed. Ordinary income rates will be applied for the COD income.

According to the IRS, the amount of the benefit must be reported as income received under IRC §61(a)(11)3, unless the taxpayer qualifies for an income exclusion under IRC §108.

When can I buy another home?

Most lenders will not offer a loan to a borrower who has filed a deed in lieu for a minimum of two to three years since it will significantly bring down your credit score. The chances of loan approval increase after a few years, especially if a borrower attempts to rebuild their credit score.

But please be aware that some alternative lenders may extend a mortgage to borrowers who maintain good credit score (680 and above) with large down payments in the 25-30% range.

Generally speaking, you will have to wait after a few years as passed and new credit has been established to purchase a home once more.

by Moe Bedard | Aug 5, 2021 | Mortgage Help |

To qualify for a loan workout such as a loan modification, short sale, or forbearance, you as the property owner must write a hardship letter to your lender to prove that you are facing financial difficulties. The purpose is to explain the details of your financial situation and the reasons why you can no longer afford your mortgage payments and detail the steps you are taking to correct your problem.

Having a well-written hardship letter is one of the most critical steps in getting your request approved. In this article, we will explain how to write one and give you a couple of examples that you can use as a template for your own letter.

When writing your letter, it’s essential to understand what your lender wants to hear. They want you to write out a solution that makes sense and will help you afford your payments and stay in your home.

You can let them know what you feel you can afford each monthly payment or even what modification programs you think you may qualify for. This will make your lender aware that you are ready to take on a new affordable loan and continue paying your monthly payments.

It would help if you remembered to be as honest as possible because your lender will also require all of your financial information and run a credit report. If your lender finds that you have lied about your financial situation, your request will automatically be denied.

Also, make sure that your letter is not too long and straight to the point. You do not want to write a 3-4 page letter because most reps will not take the time to read the entire letter. Remember that mortgage servicers and lenders are entirely overwhelmed with requests because of the current economic crisis.

EXAMPLE HARDSHIP LETTERS

Eligible hardships include job loss, income reduction, illness, relocation, divorce, medical bills, death of a spouse, etc. In your letter, you will also want to note when each event occurred and include any documentation that you can. For example, if you recently lost your job, you will want to show that you have a new job or are actively searching for employment.

Here are some examples that lenders will consider:

Divorce

Reduced Income

Loss of Job

Illness

Death in family

Military Duty

Incarceration

High Medical bills

Significant damage to property(such as vandalism or natural disaster)

Now that you know what hardships your lender is looking for, you are now ready to begin writing your own. But keep in mind that this is only one factor of the loan workout process. Your lender will not automatically assist you just by reading your letter, and there will be many other factors involved as well.

Here are two example letters were written by real homeowners and members of the LoanSafe forum who had received a loan modification from their efforts.

Name: (Your Name)

Address: (Your Address)

Lender Name: (Your Lender)

Loan #: (your Loan #)

To Whom It May Concern:

We are writing this letter to explain the extreme financial hardship it will be for our family when our loan adjusts from a 7.75% interest rate to a 10.75% interest rate in August 2020. This interest rate adjustment will cause our payment to dramatically increase in the amount of $1695 per month on top of our current payment of $4234.10, increasing the payment to $5929.10 per month. Our current income does not support an increase of this magnitude. As a matter of fact, a monthly increase of this amount will ruin us financially, and within a few short months of this adjustment, we will surely fall into foreclosure as we will not be able to afford the monthly payment.

We conducted a counseling session with a woman named Deborah Winston (888-669-2227 x742) from 995-HOPE and submitted a monthly budget where we only have a surplus of $158 per month after we pay all of our monthly obligations. According to the counselor, we are currently utilizing 54% of our monthly income for housing costs which is way above the national average.

My husband, Kevin, is the bread winner in the family and his income varies from paycheck to paycheck because of overtime, holiday pay (2 times per year), and uniform allowance. So, sometimes he makes his base pay of approximately $7839 per month and other times he makes more than that depending on the overtime he works each month. However, overtime is never guaranteed, so we cannot depend on the overtime in order to fulfill our monthly obligations.

I am currently receiving Social Security Disability in the amount of $1435 and am also the payee for our son, Christian, in the amount of $717 per month. Also, I receive a check from Calpers for my disability retirement in the amount of $829.74.

We would appreciate the opportunity to work out a loan modification where our interest rate will be frozen at the 7.75% interest rate for the DURATION of the loan, if the rate is just frozen for 2 to 5 years we will find ourselves in the same situation in a few short years from now.

Please take the time to review the information we submitted and consider our request. It is very important to us that we keep our account in good standing and preserve our credit rating as well as protect our main asset….our home.

Thank you in advance for your time and consideration in this matter. We are looking forward to working with Option One to resolve this situation. If you have any questions please contact us at xxx-xxx-xxxx.

Sincerely and Respectfully,

Borrower’s Signature

Date

Co-Borrower’s Signature

Date

————————————————————————————————————————————-

Sample Hardship Letter #2

Name: (Your Name)

Address: (Your Address)

Lender Name: (Your Lender)

Loan #: (your Loan #)

To Whom It May Concern:

I am writing this letter to explain my unfortunate set of circumstances that have caused us to become delinquent on our mortgage. We have done everything in our power to make ends meet, but unfortunately, we have fallen short and would like you to consider working with us to modify our loan. Our number one goal is to keep our home, and we would really appreciate the opportunity to do that.

There are several reasons that caused us to fall behind on our payments:

a) On July 6, 2019 my husband, was laid off from his job with IBM. He no longer receives Unemployment Compensation from the State of Florida as of January 2020.

b) Since July 2019, we went down to one income and were unable to keep up with the higher mortgage payments due to our escrow account from the beginning of 2019 being short on funds due to raised taxes and insurance coverage in Flagler County, FL.

c) In November 2020, we had to fly out of State for a family emergency which did not enable us to make that months payment.

d) Since we no longer have medical coverage, I had to pay for my visits to the doctor on several occasions due to prolonged and excessive menstruation. The Doctor Office would not see me unless I had full payment at each visit.

e) Since there is only one income in our household, but my husband helps me with my business while still looking for a comparable job, I must travel a lot. Gas prices have become extremely high, if I do not travel to do presentations and meet with clients, I cannot assure growth.

It feels like catch up for those two months we fell behind on is almost impossible, I assure you we have every desire of retaining our home and repaying what is owed to Bank of America. But at this time we have exhausted all of our income and resources, so we are turning to you for help.

Our situation is getting better because, like I stated above, my husband and I have combined forces, and we are working my business together in order to ensure stability and growth in our income, and we feel that a loan modification would benefit us both. We would appreciate if you can work with us to lower or delinquent amount owed and/or our mortgage payment so we can keep our home and also afford to make amends with Bank of America.

We truly are looking forward to you working with us, and we are anxious to get this settled so we all can move on.

Sincerely and Respectfully,

PLEASE JOIN THE LOANSAFE FORUM!

You can find more examples of various hardship letters right here written by different homeowners in the LoanSafe forum. =

by Moe Bedard | Oct 11, 2008 |

All LoanSafe testimonials are from actual members who have obtained a loan modification, short sale or some type of loan workout with the help of this one website since 2007. In the last seven years since the LoanSafe forum has been in operation, we have saved approximately 10,000 homes and families from foreclosure ( fully documented online) and countless others that have been undocumented.

Saving homeowners, lenders and communities tens of millions of dollars in the process. All without one single dime of outside funding or support!

LoanSafe.org protects families, homeowners, communities, lenders and changes lives.

Loan Safe Testimonials:

riddlemethisbatman

I feel like such an idiot, Moe. Here on the forum, I thought Evan was your brother (knew you had a son named Evan but assumed he was named after his “Uncle Evan”). I mean, I saw all those pics of little Evan…LOL. That is the crux of my shortcomings—-missing the obvious.

I am grateful for all your time and energy spent to establish and run this forum—thank you, Moe. I hope you’re blessed with the realization that what you have done has made a positive difference to so many people. God bless you.

________________________________________________________

To the LoanSafe Team, Contributors & Fellow Members;

Someway – somehow, I was lucky enough to find LoanSafe late in 2009. Yes, I might have been a little late but hustled to catch up to the wave. Truly inspired after reading Prof White’s paper on Walking Away.

There was already a loyal following when I joined LoanSafe and their personal experiences confirmed I was on the right path. Then I started making my own plans quietly & privately. I’m still a little paranoid so I’ll share the general picture:

State – CA

House Purchased – 2006

Mortgage – Conventional w/ 20% down

2009 – Underwater by at least 40%

Stopped paying Mortgage – 2010

Notice of Intent – at least 3 times

Mortgage Sold

Foreclosed – 2014

CfK – Yes

So to all the long time members, thanks for sharing, supporting and leading the way. To the recent members, don’t be shy – study hard for your particular state & personal situation, ask all those questions you have – then take the action that works best for your short & long term financial security.

To LoanSafe Team – THANKS very much for creating a platform for so many to regain their footing, learn/study all the options and then inspiring them to fight back against the Banks / Mortgage companies that wreaked havoc on our economy in order to re-establish their financial foundation. You are a big part of the solution vs the financial system that triggered hardship for so many. Forever grateful.

_______________________________________________________

Author : alohagal (IP: 71.xxxxxxxxxx) on 4/1/2011

E-mail : m*#^[email protected]

Dear Moe and staff,

I just wanted to tell you THANK YOU for this site. You are such a blessing to me and to countless others. Before this site, I was a nervous wreck. The forum has helped me kept my sanity. It has given me such a wealth of information and I didn’t feel alone. What a great support group!! I looked back on my posts and remembered how frantic I felt. And thanks to this forum, I was able to find the information and most of all the feeling that there is HOPE. This forum gives HOPE to people! Thank God for you Moe and your staff!!

I received my first mortgage modification approval last year (OneWest) and just recently, got my second 2mp (Citi) approval. It was an ordeal (end of 2009 to March 2011), but I followed the threads that was for me and got great advise from everyone!!

There are no words to tell you how Thankful I am. I just wanted to write this to tell you that I am very very grateful for all you do at Loan Safe.org!!! This website was truly a blessing for me!!! I pray that you have good health, happiness and prosperity!! : )))) May God Bless you, always!!!!

From the bottom of my heart, THANKYOU!!!! – Alohagal

________________________________________________________

Chris516 2/15/2011 – – OMG OMG I GOT MY PERMANENT LOAN MODIFICATION FROM BOFA!!!!!!! TODAY!!!! IS this a good one?

They increased my loan balance $11,373.99 (Past due interest & taxes an insurance)

They increased my mortgage term 6 years and 5 months.

My payment is $1500 less a month!!!!!!

1-5 years-2%

6-3%

7-4%

8-33-4.75%

I cant not believe after 18 months I got it!!!!

MOE, Meance HUGE CYBER HUGS!!! I found this site as a newly divorced single mother trying to keep my home and I had no idea how. Your advice guided me and without you I would have NEVER got this!!!

Yes it is a HAMP..it states HOME AFFORDABLE LOAN MODIFICATION

however I dont see the $1000, benefit?

__________________________________________________________

Kcarb 12/8/2010 -I have been browsing this site since the beginning of October (months after starting our modification review) and read posts almost every day, both happy for the successes on the forum and also full of anxiety when I read the modification stories, where the outcome is grim. We are in the midst of a mod process and it is really starting to get to me. Some days I feel hopeful and others, not at all. I am so impressed with the amount of knowledge that this forum provides.

__________________________________________________________

Member Kirkspal Joined August 2009

Well, after 25 months, forbearance, 2 trial mods, 15 trial payments, and a foreclosure notice, Chase has modified my mortgage!!! Our foreclosure sale date for our house was to be Feb 16, 2011. Woo hoo, we get to keep our house! I take it as being official today. I have not received the signed agreement back from Chase but the website has our updated information listed after being “unavailable” for a while now.

IT CAN HAPPEN PEOPLE. I have felt hopeless, depressed, and angry for 2 years now. Don’t give up the fight if you really want to keep your home. I have been living scared for so long I feel like I can finally breath. Our new payments are still a lot for us but we are going to make it work.

THANK YOU MOE AND EVAN AND EVERYONE ON THIS SITE THAT KEPT ME GOING. Good luck to everyone still in the fight

https://www.loansafe.org/forum/chase-mortgage-tell-us-your-chase-story/36020-1-more-success-moe-evan-25-months-making.html

______________________________________________________

date Fri, Sep 10, 2010 at 9:13 AM

subject Re: Happy Birthday from Mortgage Forum – LoanSafe.org

Thank you and this forum for everything. Helped me save my home and my sanity!!

Shawna

Founding Senior Stylist &

New Stylist Trainer, Gigi Hill

____________________________________________________

9/5/2010 – Hello Moe, I just wanted to tell you, your website has saved my life (literally), I stumbled on your site in the middle of losing my home, I was able to network with people going through the same thing as I am. I didn’t feel alone anymore, I have tried to give back and counsel those that haven’t walked in my shoes yet. We hear so much about what is wrong with America, I just wanted you to know, you are whats “right” with America. I am known as “Homesweethome” on your site, and thank you again.

Nina Mitchell

_______________________________________________________________________

LinkedIn

Linda has sent you a message.

Date: 7/27/2010 Subject: you saved my life

Hi Moe – about 8- 9 months ago I found your website. I read other “victims” stories and knew I was not alone. I email BoA

president Barbara as suggested and it worked. I have been in the Loan Mod with them since January and just have to push to get the final paperwork done. But I could live and enjoy my life when I got the help from you.

Maybe we have learned hard lessons – but you actually do something about it for us little guys. Mille grazie! Linda

_____________________________________________________________________________________

Dear Moe,

This is unbelieveable, but I have great news!

I just received a phone call today from my lender Indymac and they finally gave me the HAMP program loan modification after 1 year of fighting. I did contact HUD counselors who have assisted me through this present request for a loan modification. I would definately suggest everyone to contact HUD to have them assist and represent anyone with their loan modification. I had been denied 5 times in the past year. It has now been 1 year almost to the date and it seems as if the bank just waited for me to go into foreclosure to really consider doing this. As of this weekend 7/30 I would only be 30 days away from a trustee sale.

First of all I want to Thank God for this miracle. And, I want to thank you for so kindly responding to my email. I wish to pass along this information to any and all others of thousands of people who are still fighting for their true right to a loan modification and help everyone everywhere and especially on your website. I love your website and God Bless and thank you so much for it. It has truly helped me to keep in touch and updated and given so much great information to keep my head and heart lifted up when I was drowning in pain and fear. I pray for everyone on your website everywhere tonite and for you and your family for doing such a wonderful giving thing for so many people.

I will still stay updated and wish you and everyone the best blessings. We all deserve a second chance to keep our homes and maybe the banks will realize this as things just get worse and worse. Afterall, they are and have nothing without us homeowners. You are right, keep on fighting, screaming and kicking.

These are our homes! Thank you again.

Respectfully Michele

_________________________________________________

My name is Anita Nelson and Loansafe.org helped me and my husband save our home!!! I am a true success story and without this site we would not be in our home!

We bought our home in July 06 in Stagecoach Nevada. Our purchase price was 333,000 we obtained a loan with the help of the seller doing a carry back of 64,000. Immediately after the loan closed the seller started harassing us to get that paid even though we had 5 yrs. We refinanced 6 months later into a horrible loan with 11.65 % interest rate with a payment of $3515 a month (that didn’t include taxes or insurance) the broker said its ok, do this for 6 months, I will get you 11,000 to pay the payments and it will all be ok.

Well it wasn’t!!! After 6 months he couldn’t help and almost a year later when the 11,000 was just about used up with helping making the payments Avelo Mortgage paid our taxes. They were not late, the bill was sent to them by misstate and they paid them and raised our payment $288 a month!!! Now I knew for sure that we couldn’t do this much longer our payment was now $3800 a month. I called Avelo and they said I could apply for a loan modification, which I did and 1 month later was denied with no reason at all!! Deals off, which was their exact words!! I was crushed. I had to tell my husband we were going to lose our home.

That was in October 07 I will never forget the day my husband said to me, you don’t give up, you are a fighter and I know you can figure this out! So the fight was on!!! January 25, 2008, I found Loansafe. I joined right away and told my story. That same day I had so much advise on what to do and where to start. With the guidance from the moderators on the site I finally got up enough nerve in February to do a QWR, write letters to everyone I could, did an interview for our local news and called called called Avelo daily, every single day I called. I was determined to be a pain in the ass!

On February 18th Avelo called me as I was driving to work and her exact words were, What can we do for you Mrs. Nelson to help you with your loan? I explained to her that even though my loan isn’tt going to reset for another year we just can’t do the payments. She went over our financials and said we qualified for a loan modification. I faxed here everything she requested by Friday February 22nd and she said it would be a month before we knew anything.

On March 7th, Gil from Avelo called and said our modification was approved; new interest rate will be 6.75% fixed for the life of the loan with a new payment of $2686 a month and that includes taxes and insurance. No payment was due for March and new payment starts April 1st. I was and still am delighted. We are still on cloud 9 even though it has been a few months of our new modified loan.

Our lives have changed so much. Our home wasn’t purchased to be an investment it was purchased because we love it and it is where we want to spend the rest of our lives. It is OUR HOME!!! And it wouldn’t be without Loansafe, Moe, Cat, Andrew and everyone else.

I just really want to say Thank you from the bottom of my heart!!!

Anita Nelson

Loan Safe success # 65

P.S. Moe should have a copy of my modification; I did email it to him when I got it for him to have for his success file!!!!

_________________________________________________________________________________________

JacMac – Homeowner and single mother from New York – I want to wholeheartedly recommend this forum to those who just popped up here or may have been lurking and are scared, unsure perhaps you’ve just realized you’ve been taken for a roller coaster ride, and the price of the trip is more than they said, more than you can afford — the point is, the forum is a wonderful place, and it is SAFE!

The internet can be a scary place, with people posing as someone who wants to help you but what they really want to do is make a buck. This is NOT one of those places.

You can save your home OR do something about what is happening to you. Even though you’ve been victimized, you don’t have to be a victim. Take power over your life again!!!

This forum can help you make choices that are right for you, and you’ll be amongst people who are just like you, and who care. I’m speaking from personal experience AND I’m not getting anything for saying this!!

See Jac Mac’s loan modification. Courtesy of Loan Safe!

____________________________________________________________________________________

Andrew P. – Homeowner, police husband father of twin boys from Pennsylvania saves his home. (Now a Loan Safe moderator & also a. A perfect example of the power of paying it forward and the power of this website)

Received an apology letter and loan mod via fax from countrywide office of the president. Secretary of Mozilo called and asked if they can fax along with mail the documents. Maybe tomorrow will send Moe and email with the scanned letters to post.

If you go back and read some of posts I have been worried about my mortgage for a while now. I had originally called in August and asked about it but was told since I’m not late they couldn’t do anything. Then in October when I called again I was told that I could apply. After months and who knows how many hours on the phone.

I was finally approved for a 5 yr freeze on mortgage. I even had to go as far as threaten to rescind my loan and send RESPA letters with the violations Brian had found. I really am very grateful of Moe for this site and his wisdom and guidance. I feel very stress free right now. I will be staying on this board to help others who were in my predicament too.

THANKS AGAIN MOE !!!

See Andrew’s loan modification from the Office of the President Of Countrywide, Angelo Mozilo

_____________________________________________________________________________________

To Whom It May Concern:

All was well till my husband’s job laid him off for 2 weeks in 10/06. That 2 week lay off lasted 6 months at which time he took on a new job with a 25% reduction in pay.

We had Litton Loan Servicing with a 10.5% ARM 5/30. Needless to say nothing was paid timely. In 3/07 we contacted Litton to apply for a modification, they granted us a forbearance plan increasing our payments an additional 1200.00 each month for 18 months. Our payments went from 3041.94 to 4200.94 just trying to save our home.

Needless to say we zeroed out all of our assets to meet this obligation until the well ran dry in 10/07. Hence, we break our forbearance plan.

In October we contacted Litton begging/pleading and crying for a more affordable monthly payment to no avail. November and December the same result NO HELP.

Christmas comes and Christmas goes or lack thereof (picture no X-Mas with 3 children) and an Italian Husband. We’re talking no gifts no seafood no nothing.

Right after the New Year 01/08 we get fired up and are determined to be heard. We can afford our home but we cannot afford to catch up.

To Google we go.

We trip on Loansafe.org. Now I will tell you we were skeptical. Who helps others for free? Better yet how many other people could really be under a Notice of Default? Boy, were we shocked.

We became part of the Loansafe family in 01/08. And we say family because that is what they are. Family helps out family and boy did they help us out. 24 hours a day, seven days a week. No question was too stupid for them to answer and let me tell you we asked some real doozies.

With the hand held assistance from our family at Loansafe most specifically Cat but at times Moe as well (he is really busy) we learned how to fight for ourselves and win.

Our fight started in February and we won our modification in April. We went from 10.5% to 8% for 5 years J a savings of more than $300.00 each month.

You would think that is the end. NOT.

Cat offered to review our modification documents for us so that we could sign then with piece of mind. We scanned them to her, she gave us her stamp of approval and off to success we went.

Still think it’s over. NOT.

30 days after our online account is updated with the new payment amount and zero arrearages Litton contacts us and reveals an escrow shortage that will drive our monthly payment back up and over the top, worse than when we started the modification.

I report this back to my family at Loan safe and once again Cat rescues us. She recommends we contact Litton and ask them to stretch the shortage out over 3 years. Once again we followed her advice to the T and Litton agreed.

Now although I owe my home, sanity and happy life to Cat and Moe I also owe it to all the members on Loansafe who supported me through those very, very long sleepless and crying nights.

Thank you Loansafe

Joseph and Lynn Arena

_________________________________________________________________________________________

Dear Moe,

I have been fighting to keep my home since 2003. To me it’s not Real Estate. It’s where my 10 year old son has grown up, where birthdays and Holidays have been so special, and where family and friends in town always feel safe and warm and loved. I was blessed to grow up in a place like that on 2.5 acres in Riverside California, and I’ve done my best to duplicate that atmosphere on my acre here near Wellington Florida.

When I read your words and quotes on your website, I felt like I had been surviving alone in the desert and someone had just given me a 5 gallon container of purified, ice cold water. Thank you for being here. And thank you to everyone who has contributed to the site. It is truly one of the most wonderful contributions to the world imaginable. And that is in no way an overstatement. Please accept my heartfelt Thank You Moe.

Warmest and Kindest Regards,

Damon H

______________________________________________________________________________________

Dear Loansafe.org:

I bought my first house in February 2006, which I was so happy. I was making my monthly mortgage payments on time until I ran across some financial difficulties that was totally unexpected. I even ran out of my emergency money just to keep up with my payments. I fell behind by one month and I tried to get my mortgage company, Countrywide, to help me to work something out. Well, in November 2007, I was told that I could apply for a Loan Modification because my Adjustable Rate was going to change in February 2008 and obviously I could not qualify to refinance.

I sent the necessary paperwork, (i.e. paycheck stub, bank statement, hardship letter). It took Countrywide two months to respond. In January 2008, I received a FEDEX package with my loan modification approval to temporarily lock my rate until 3/2013. I sent the paperwork back (got it notarized) to Countrywide, which they received it on 1/28/08. Well, after speaking with customer service and attempting to speak with someone with the loan workout department, I started sending my new monthly payment in 3/2008, as agreed. From March to June 2008, I received paperwork indicating that I was in default and possibly the loan foreclosure process could be initiated. I tried calling the loan work out during that time, which I was getting nowhere.

Then one day, I decided to search on the Internet on any information that can help me with my situation. That’s when I found out about Loansafe.org. That was a blessing because a lot of the information on the site was very helpful. And after reading a lot of the blogs, I found out I was not the only one going through this. I started a new thread with my situation and Cat responded right way. I was amazed. She gave me a telephone number to Tabitha at Countrywide. After speaking with her, I got my situation resolved in a week. I was thrilled that finally this was corrected.

I also wanted to mention that during that week waiting for my account with Countrywide to be corrected, Cat and other bloggers were so supportive. It helped me a lot because this was so stressful to a point that it started to affect me emotionally and physically. Anyone who is going through this mortgage crisis should go to this website. Moe, Cat and the others are truly Angels for helping people like me who are going through a difficult situation. I cannot stop raving about this site. I even referred a friend of mine who is going through a similar situation and I believe she is in the process of getting her situation corrected, also.

I want to say THANK YOU, CAT, MOE AND THE OTHERS ON LOANSAFE!!! You really helped me and I hope you continue your success in helping others like myself.

Sincerely,

Yvonne Bowen

Lancaster, CA

______________________________________________________________________________

I started the loan modification process on 11/20/07 by sending in my financial info, pay stubs and bank statements. I followed up every week and did not really get the best feedback.

In late December, a great loss mitigation rep told me that I “fell through thru cracks” and gave me another fax number to send my pay stubs and bank statements. She told me that she would help me put a rush on my application. She also told me that after receipt of the documents, they would put the foreclosure on “hold”. I think “hold” means moving the sale 90 or more days.

Well since I have followed this GREAT website, I have been calling every day since about 1/3/2008. On 1/10/2008, they told me that my complete package was received and accepted on 1/7/2008 (official start date I guess)

Since then I have been calling every day to follow my file. The loss mit dept at Chase has been very good. Everyone is polite and patient.

Today I called and they told me that I am approved! and will be receiving my loan docs in the next few days! They did not tell me the interest rate because it was not available (not sure if true) but they did tell me the down payment ($8152) by 2/14. I asked about the step program(thanks to the website explaining that) and they said that I was recommended for that (whatever that means)

So needless to say I am happy and anxious to receive my docs. My loan mod process so far has been about 30 days since the official (1/7/08) date.

_______________________________________________________________________________________

Bob – Homeowner from San Diego – I have finally got my loan fixed for 5 years @ 5.99%. Fully amortized loan..principal and interest. After almost 6 months of doing battle with Countrywide I am done. I have to make two more payments (Jan. and Feb.) at 7.45% but then in March 08 it goes back down to 5.99% saving me $610.00 a month! Great news!! I do not even have to sign any paperwork. They said it is a done deal and I will probably receive a letter in the mail today.Here is a link to my original thread:

https://www.loansafe.org/forum/showthread.php?t=162

Hopefully 5 years will buy me enough time to pay down my second mortgage and put me in a good position to refi. I want to thank Moe Bedard, Brian and all the forum members for all your help and encouragement. I never would have been able to keep my home if it wasn’t for the knowledge I gained from www.loansafe.org. Thank you all so much!!

Do not give up!! Keep up the fight!! You to can stop foreclosure!!!If anyone needs any help or advice in dealing with CW from someone who has been through it, just drop me an email at

[email protected] and I will do whatever I can to help.Paying it back and forward is the way to go!

________________________________________________________________________________________

Thanks again for all the congrats! Well I got my docs today! As promised my loan is at frozen at 5.7% for 5 years!! My modification did not cost anything and we do not have to make a March payment.

In the cover letter, it said to return the application for auto withdrawal of payment, but package did not include app. so I called our negotiator Christy Mcgowan (very nice girl) and she said that it would not be necessary, it was an oversight on her that she didn’t omit that part. She also told me that it was not possible to modify our second rate (9.875%) That is fine by me, because it is fixed and I was really only worried about the first! It would have just been the cherry on top! I still can’t believe that this is a done deal! I am so happy and relieved!!!!

Here are the biggest misconceptions that kept me from even trying the modification route until I found Loansafe.

1. You have to be late in order to qualify for a modification

2. You must have a serious financial hardship

3. It takes 3-6 months

4. You can’t do this yourself!

5. It’s a pain in the a$$!!!!

Reality

1. I was never late

2. good steady income, but no LTV

3. 5 weeks

4. You CAN do this yourself!!!! (with the help of y’all)

5. It’s a pain in the a$$!!! No gettin around that one! I lived at the Kinko’s fax machine!

All in all my case was “easy”. My only real problem was LTV. I feel for so many of you out there that are in much more dire situations than my family and I hope that each and every one of you can find the best solution for you. Don’t give up! Call call, call, call and fax, fax, fax” I am positive that the turning point in my case was the QWR. It definitely put some fire under their bums!

Thank you,

Shannon AKA shannonek – Member and a “Success with CitiMortgage HELOC ”

_______________________________________________________________________

We were very lucky. I am relieved this is all over. But, I’ve learned so much these last five months. On Saturday, my husband and I volunteered at the local homeless shelter. We know how fortunate we are to still be in our home. It’s our time to give back to those who are not as fortunate. We are both committed to doing this monthly, to remind us our journey and to be thankful for being given a second chance.

To all of you still fighting your battle, don’t give up. Stay in contact with your lender until you’re even driving yourself crazy. Ask questions, explore options, and contact elected officials. Don’t be afraid to tell your story to anyone who will listen. I will continue to pray for all of you, that all of you will find a permanent solution as well.

Thank you to Moe, Poppy, Cat and Andrew for all of your advice, support and encouragement. I could not have done it without you!!!!

echo2 “I did it!!! Modification approved!!!!”

______________________________________________________________________________________________

Well, today I received a call from Citi Mortgage that our mod application had been approved. Our first payment is due in April. We can skip March’s payment.

The whole process took about three weeks. We will be getting our loan mod papers via UPS this Friday!

Three weeks ago, I sent in my paperwork, financial information, hardship letter etc. to the mod department.

I called to follow up shortly after and inquire as to whether or not they had received my documents. I was told that they had and that if I didn’t hear back by March 1st to give them a call.

I decided to email three people with Citi Mortgage. The CEO and two others from the office of homeownership preservation. I emailed them last Thursday and explained my situation to them. I got an email from one of them the next day letting me know that someone would contact me by end of business on Monday (two days ago). Sure enough, someone did. This person took financial information from me over the phone and asked me to fax him a hardship letter, my W2’s and a pay stub.

The next day, Tuesday, the closer sent off our package to the underwriter. Today, Wednesday, we received a call from the closer letting us know that our application was approved and we were all set.

Our interest rate went from 13.6 to 2% for the next two years. After the two years are up, they will review our info again and determine whether or not another modification is needed. Our monthly payment went down by over 500.00 dollars!

I’m still stunned.

A few more details. We were never ever late on this loan. Nor have we ever been over 30 days late on our first mortgage.

Now, we are working on modifying our first which is set to reset on December 2008.

So, there you have it. It can be done!

salvega530 – Member “Chase Success III”

Hello everyone!!